Indian pharma stocks rallied up to 4%, led by Divi’s Labs, Lupin, Cipla, Aurobindo Pharma and Sun Pharma, after HDFC Securities highlighted improving long-term prospects for the sector, especially in the CRDMO (Contract Research, Development and Manufacturing Organisation) space.

Key Reasons Behind the Rally

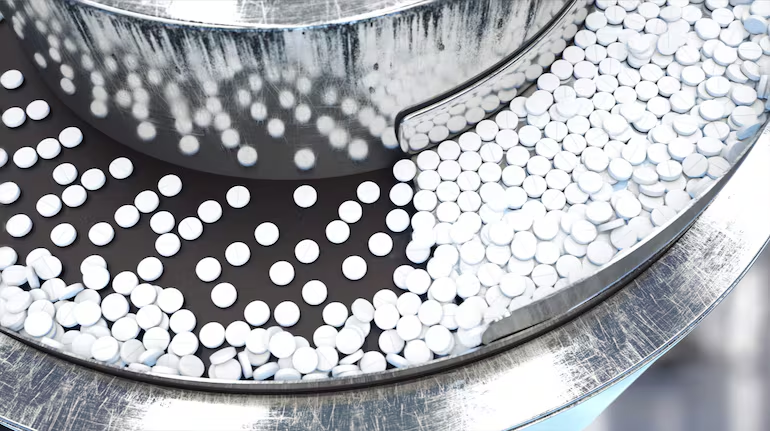

1. India’s Growing Share in Global CRDMO

- India’s share in the global CRDMO market is expected to rise from 3.8% in 2024 to 4.7% by 2029

- This implies steady volume growth and higher export opportunities for Indian pharma companies

2. China+1 Shift Benefiting India

- Global pharma companies are diversifying supply chains away from China

- Indian players are gaining from:

- Cost competitiveness

- Regulatory credibility

- Strong chemistry and manufacturing skills

3. Margin Expansion Ahead

- Falling input costs

- Normalisation of freight and energy prices

- Better capacity utilisation at CRDMO facilities

HDFC Securities expects operating margins to improve over the next 2–3 years.

4. US Pricing Pressure Easing

- Price erosion in the US generics market appears to be bottoming out

- New product launches and complex generics should support revenue growth

Stock-Specific Triggers

- Divi’s Labs: Strong CRDMO pipeline, recovery in custom synthesis demand

- Lupin: Improving US portfolio, respiratory and specialty products

- Large-cap pharma: Defensive earnings + export-led growth appeal

Why the Sector Looks Attractive Now

- Reasonable valuations compared to historical averages

- Stable cash flows and low leverage

- Defensive play amid global geopolitical and market volatility

Bottom Line

HDFC Securities believes pharma offers a rare combination of visibility, growth and defensiveness, making it attractive for medium- to long-term investors, especially as India strengthens its position in the global pharmaceutical supply chain.

If you want, I can also break down top pharma stocks to watch, CRDMO leaders, or risks to the sector going forward.